Mass. voters likely to decide minimum wage, tax “millionaires”

Little is cast in stone yet, but it appears that Massachusetts voters in November will weigh in on several diverse matters, from raising the minimum wage to taxing “millionaires” to defining the rights of the transgender population.

Massachusetts law allows for three different kinds of binding votes, and this year’s ballot may feature all three. A tax surcharge on the wealthy has been proposed as a constitutional amendment, while proposals to raise the minimum wage and to require employers to offer paid family leave are proceeding as so-called initiative petitions. A third form of ballot question, the referendum, is being employed in an attempt to roll back a law guaranteeing certain rights to transgender persons, including the right to use bathroom based on their “gender identity.”

The most often-used form of ballot question is the initiative petition. Last year, 28 ballot questions were proposed for the November 2018 state election ballot, but one-quarter were ruled ineligible for various reasons, and more than two-thirds of the rest failed to garner enough signatures to proceed. The rest were referred to the legislature, which always gets the chance to enact each measure directly rather than allowing it to go before voters.

The most often-used form of ballot question is the initiative petition. Last year, 28 ballot questions were proposed for the November 2018 state election ballot, but one-quarter were ruled ineligible for various reasons, and more than two-thirds of the rest failed to garner enough signatures to proceed. The rest were referred to the legislature, which always gets the chance to enact each measure directly rather than allowing it to go before voters.

What usually happens instead is that legislators negotiate with the sponsors of each ballot question; if a compromise is reached, the backers are spared the cost both of gathering a second round of signatures and of campaigning in support of their proposals. This year, however, the legislature missed its deadline, so the next round of signature-gathering has already begun on each of these five questions:

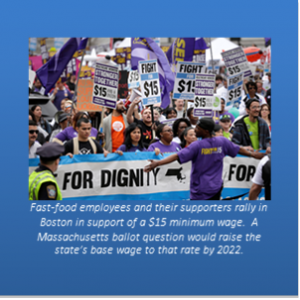

- Minimum wage. A compromise on a 2014 ballot question raised the state’s minimum hourly wage from $8.00 to $11.00 in three stages. This year’s measure (17-17) would boost it further to $15 by 2022. The same question would increase the lower minimum for tipped workers from $3.75 to $9.00 over the same period.

- Paid family leave. Another proposal from the same labor-backed organization would employers to provide up to 16 weeks of paid family and medical leave, including leave during the first year after childbirth or adoption. This measure (17-18) would also guarantee that upon their return to work, employees must be restored to the same positions as before, or to equivalent ones, with the same pay, status, seniority and benefits.

- Sales tax. Voters have from time to time lowered the state sales tax rate, only to have the legislature raise it again to balance the budget. This proposal (17-19) would cut the current rate from 6.25% to 5.0% and would require that the state provide for a recurring two-day sales tax holiday in August of each year.

- Money in politics. Other attempts to use initiative petitions to overturn the the Supreme Court decision in Citizens United v. FEC have been ruled overly broad under the state constitution. This one (17-03) would merely get the ball rolling by creating a nonpartisan commission to draft a proposed constitutional amendment limiting the influence of money in Massachusetts elections.

- Hospital staffing. A final issue heading to ballot in 2018 stems from a dispute between unions and hospitals over the workload assigned nurses. The Massachusetts Nurses Association actually submitted two proposed ballot questions (17-07 and 17-08) to set limits on the number of hospital patients assigned to each nurse; the more far-reaching measure was declared unconstitutional by Attorney General Maura Healey, but the nurses contested this decision in court and proceeded to collect signatures in support of both versions.

Now that the legislature’s May 1 deadline is passed, supporters of these measures are again collecting signatures, in a second round that requires them to gather 10,792 additional signatures by June 19. Practically speaking, lawmakers have until that June 19 deadline to negotiate compromises so as to persuade backers of these questions to abandon their efforts to place them on the ballot.

Two other questions appear headed for the same ballot, although one could yet be derailed by a court challenge.

A proposed constitutional amendment would impose a so-called millionaire’s tax had already qualified for the ballot, but is being challenged in court by a consortium of business organizations. 15-17 was filed in 2015 and received at least 50 votes in favor in two successive legislative sessions, thus qualifying it to go before the electorate in November 2018. The measure would amend the state constitution to allow for a higher tax rate on incomes over $1 million, while earmarking the extra revenue for education transportation projects.

But the state’s Supreme Judicial Court heard arguments in February in a lawsuit seeking to block it from appearing on the ballot. The legal challenge is based not on the principle of making the wealthy pay more, but on the earmarks. It argues that this amounts to an unconstitutional restriction on the appropriations power of the legislature. The lawsuit also contends that the scope of proposed amendment is illegal, since the constitution says that each such question cannot include unrelated topics.

Also headed for the November ballot: a referendum to repeal a bill passed by the legislature in 2016. SB 2407, “An Act relative to transgender discrimination,” prohibited discrimination based on gender identity and explicitly specified that transgender persons could use restrooms and locker rooms that “match their gender identities.” This referendum petition, which has already secured a place on the November ballot, would rescind the action of the legislature by repealing SB 2407 outright.

It is not uncommon to find a few ballot questions on the state election ballot in Massachusetts. But if all seven issues reach the ballot, Massachusetts voters will be making policy across a broad swath of topics, while at the same time electing a governor, a U.S. senator, its U.S. House delegation, and all members of the state legislature.